To our valued customers - Due to the closures of Modern Tool Alberta stores, Modern Tool British Columbia is still here to serve you coast to coast! For all your machinery needs please contact us today!

Our Services

.jpeg)

New Machines

For the fastest response, please include a full description of the equipment and your asking price. Be sure to attach any images or any other files that will help our buying department review your submission.

Can't Find?

If you cannot locate the equipment on our website, fill out the form below and provide us with information on the equipment needed.

Leasing

Modern Tool BC has leasing programs available through our trusted local partners, or we can work with your preferred financial institution, or credit union.

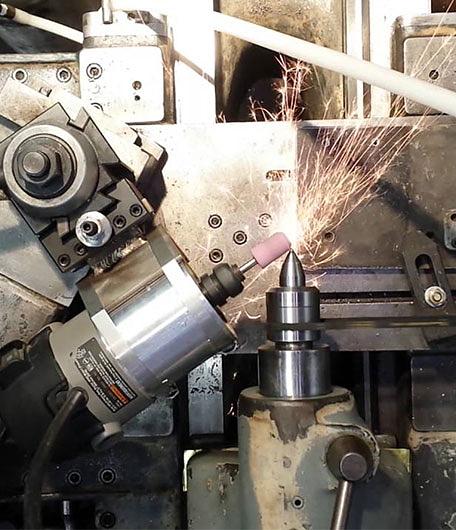

Service Department

Need your equipment serviced? Our service department is available from Monday to Friday 8am to 4:30pm. We offer extremely competitive rates, and our technicians are fully trained and qualified. We’ll come to your office or shop and complete the work requested on-time and on-budget.

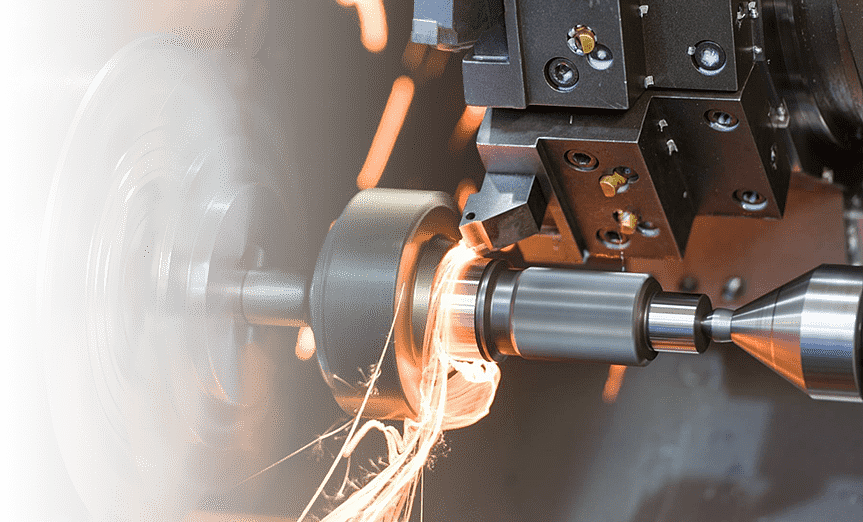

About

By dealing with major manufacturers, we are able to provide you with any type of equipment. Whether you are looking for press brakes, shears, benders, iron-workers, grinders, plasma tables or saws, we have it all! We are 100% owned and operated in Canada.

Contact

Modern Tool BC is here to help. Reach out to us if you are looking for more information.

Sign Up For Our Newsletter

Subscribe to stay up to date on all the latest information and seasonal specials!

.jpeg)